Should you repay your loan early or make the monthly payments while investing the rest? The answer depends on the loan, the interest, personal finances, and what motivates you.

For high-interest credit cards, the answer is always yes: pay it back as soon as possible. With high interest rates that can exceed 25%, this type of debt is the first you need to get out of. The same applies to other kinds of high-interest loans.

However, this question is more relevant to long-term loans like mortgages for your home or student loans. In this case, there are valid reasons for both sides of the argument.

Why you should

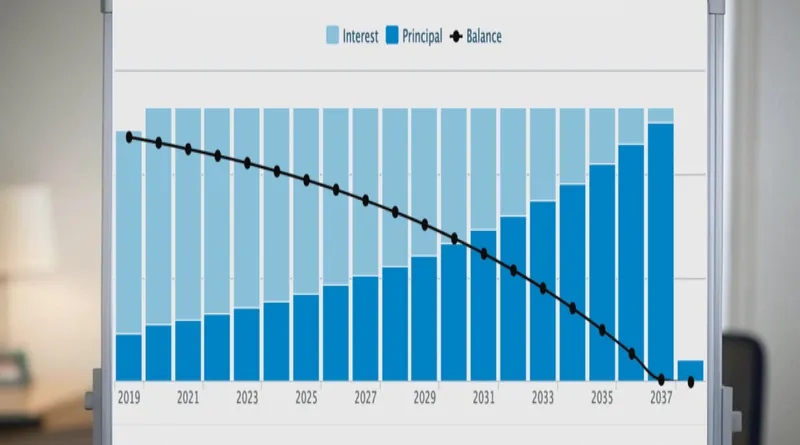

Loans are generally structured with a fixed monthly payment, but the interest-to-principal ratio is not constant. In the first years of the loan, the interest makes up over 90% of each payment on average, and over the years, it gets more balanced; in the 2nd half of the loan, it pivots to more principal being paid, while in the last years of the loan, it’s over 90% principal. So, making an early payment on the mortgage in the first few years has a significant financial impact. However, these are precisely the years when you can hardly have those extra financial resources.

Besides the reduced interest paid, some recommend this, even to the detriment of savings, because it has a big psychological boost. The morale boost you get from paying down your mortgage and finally owning your home is immense. This motivation can make you save more intensely than you would to increase your savings account.

Why you shouldn’t

There’s a saying in banking: the bank will give you an umbrella when it’s sunny outside and take it away when it starts raining.

With every extra payment you make towards your mortgage, you reduce your liquidity. If you need a loan again, the bank may refuse or have higher interest rates.

Also, in most years, with a safe investment strategy in the stock markets (more on that in our articles on investment), you can make a return 2x or 3x higher than your mortgage interest rates.

Conclusion

Most times, paying back the low-interest loans in advance is not mathematically the best option. Still, if that motivates you to save more, then it’s certainly recommended. The only thing you need to pay attention to is to make sure you have plenty of savings to carry you through rainy days should they come, and not allocate all your savings into early payback of the loans.