A spreadsheet is probably the default solution someone thinks of when deciding to track personal finances.

There are advantages to this simple solution, but also some disadvantages. We’ll go through both, share some basic templates for using Excel, and provide a better solution for the problem.

Let’s start with the advantages:

it’s easy to use

- can use Excel from Microsoft, Sheets from Google, Numbers from Apple, or any of the many existing spreadsheet solutions

- it’s yours: you can save it on your local machine

- it’s flexible: if you decide to drill down, you can customize it to whatever works for you

But there are also disadvantages:

- a lot of manual work to add transactions

- hard to automate recurring transactions

- hard to create good reports

- hard to edit on the go

- hard to attach files to it

Before we give you some templates, we’ll quickly go through an alternative to the spreadsheet: personal finance software.

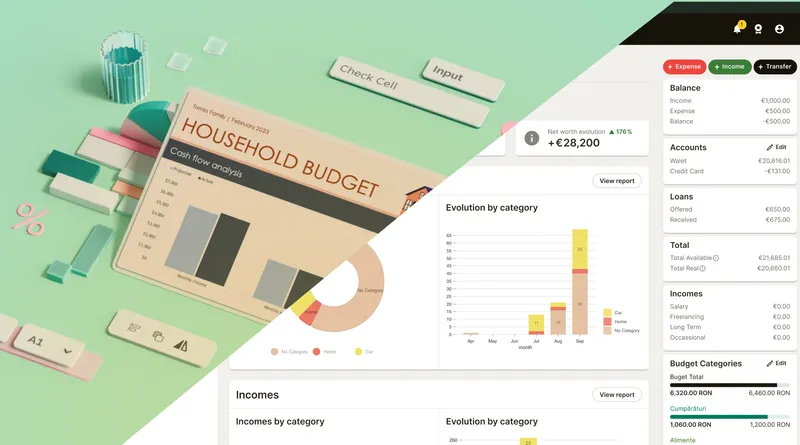

We’ll use our CashControl solution to present some advantages of using software instead of spreadsheets:

- a much better interface: adding and viewing transactions is much better optimized than what a spreadsheet can offer

- ability to synchronize with your bank account or import bank statements

- automated recurring transactions

- ability to attach files

- dedicated mobile app

- advanced features that are impossible to build in spreadsheets

If you’d like to try the software approach, you can register for a free account using the link in the header.

If you’d like to stick to spreadsheets, as promised, here are some resources:

- Microsoft365 Personal Budgeting templates

- Vertex42 Personal Budget Spreadsheet (Excel, Google Spreadsheet)

Before we built our solution in 2011, we too had been using spreadsheets for our personal finances, but we were convinced there needed to be a better way, so we built CashControl. Now we can’t imagine going back to spreadsheets.